Irreversible Industry Trends, and What to do About Them

Posted by | Fuld & Company

Irreversible market trends often stem from the entry into an industry of smart companies that drive change and find innovative ways to compete. Newcomers can spot, and capitalize on, shifting market dynamics and consumer preferences, ultimately capturing market share right under the noses of industry incumbents. A key component of anticipating the disruptive entry of new players, and refining a firm’s competitive strategy accordingly, is the notion of indications and warning – ongoing vigilance of market signals and the ability to interpret them to anticipate future market conditions.

An important market signal emerged last week in the United Kingdom; one that confirms the ongoing upheaval in the European broadcast entertainment industry. According to a report in the BBC, video streaming services such as Netflix and Amazon Prime now have more subscribers than traditional pay TV services in the UK.

Understanding the Strength and Directionality of Disruptive Trends

Indications and warning analysis requires that we first ask about the strength of the directionality of the apparent trend. In this case, have we indeed crossed a threshold marking a dramatic change in how individuals consume video entertainment content, and is there any going back? To answer that question, let’s seek out more data to confirm the diagnosticity of the original indicator.

Network gear manufacturer Cisco predicts that IP video traffic will represent 82% of all consumer internet traffic globally by 2021. What’s more,

- By 2021, a million minutes of video content will cross global networks every second

- It would take more than five million years to watch the amount of video that will cross global IP networks each month in 2021

- Consumer video-on-demand traffic will nearly double by 2021, to the equivalent of 7.2 billion DVDs per month.

We probably can comfortably assess then that, in the UK market, there is no going back. If so, these indicators are indeed diagnostic in their ability to warn of future market conditions that carry implications for market participants. Our next question, then, is what to do about it.

Common Missteps When Addressing Disruptive Market Shifts

History has shown that when irreversible trends are fundamentally reshuffling industry structure, the incumbents in those industries do one of two things:

Ignore the trend and hunker down on their business model that is in the process of being disrupted.

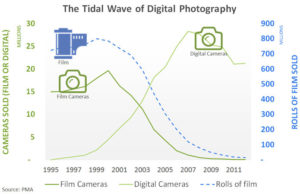

The classic example of this behavior, of course, was the Kodak corporation. Faced with a declining film photography business as the proliferation of digital consumer photography accelerated, Kodak faced its irreversible trend moment in 2002-2003 when, by some measures, the number of digital photographs exceeded the number of film photographs. Once that line was crossed, there was no going back.

To be sure, there were many forces at play that propelled digital photography to surpass film photography at this time: there was a tremendous increase in the number of digital cameras available, and camera phones were just starting to gain traction as a picture-taking option for consumers.

However, instead of embracing the trend and working diligently to re-shape its business to participate in the new emerging industry structure, Kodak did just the opposite. It worked hard to sustain an obsolescing business model. Certainly, moving away from a business model that for Kodak was highly vertically integrated and was the source of high margins for nearly 100 years was not easy. But, to fail to acknowledge the inevitable disruptive threat to which that business model was subject was, as we now know, a critical mistake.

Mimic the entities that are responsible for propelling the trend.

While imitation may be the sincerest form of flattery, in business it could also be the least effective manner of competition. Incumbents that try to copy the rule-breaking strategies of new entrants violate one of the most fundamental tenets of strategy: that organizations should seek to perform different activities from their rivals or perform similar activities in different ways.

Yet, a copycat strategy is exactly what established UK media companies seem poised to pursue. Sharon White, the Chief Executive of Ofcom, the UK’s communications regulator, said “We’d love to see broadcasters such as the BBC work collaboratively with ITV, Channel 4 and Channel 5 so that they have got the scale to compete globally, making shows together, co-producing great shows that all of us can watch.” She adds, “I think it would be great to see a British Netflix.”

Netflix Global Coverage Map

How Do Incumbent Companies Adapt to Irreversible Market Shifts?

If ignorance and mimicry are not viable competitive strategies, what then, can incumbents do in light of indicators of irreversible disruptive trends that could represent an existential threat to their business? For me, it starts with the perspective the incumbents have about the market, and their position in it.

- First, ask yourself, how do I view my competitors.If the UK’s broadcast TV networks see Netflix as a technology company, not a media company, they risk occupying an incorrect and ineffective competitive posture against Netflix. I recently wrote about the importance of re-checking how you define your competitors, and how obsolete definitions of their value propositions can lead to ineffective competitive strategy.

- Next, conduct an honest comparison of your firm’s strengths and weaknesses against the competition – both other incumbent players and new entrants.Where to you outperform them? Does your organization have better access to capital? Are margin expectations different? How do your cost structures compare? These are fundamental questions that must be the basis of any competitive strategy discussion.

- Finally, match your firm’s strengths with the opportunities that industry disruption presents. You may find, for instance, a strong ability to better position in light of emerging industry trends by pursuing licensing or M&A deals, as your firm’s access to capital and processes for merger integration far exceed those of your competitors. Or, a customer segmentation analysis may find new ways to serve customer segments that new entrants cannot reach. The goal here is to generate options that play to your organization’s strengths when evaluated against the new industry rules.

Companies need not be paralyzed when confronted with unmistakable indicators of industry disruption. Don’t let panic give way to mimicry. An objective assessment of market signals, followed by an honest assessment of how your organization’s strengths align to new opportunities presented by disruption, can be the key to a viable and future-proof competitive strategy.

Tags: CI Process, Competitive Strategy, Disruption, Early Warning & Monitoring, Europe, Ken Sawka, Market Analysis, Strategic Planning, United Kingdom (UK)